Enterprise Valuation • Estate & Gift Tax Valuation • Cost Segregation

Cost Segregation Methodology

Engineering-Appraisal-Based | IRS-Defensible | Institutionally Aligned

Cost segregation is often presented as a tax optimization technique.

At us, it is practiced as a discipline of valuation economics and engineering-based asset classification, designed for assets where capital intensity, system complexity, and regulatory scrutiny materially affect recoverability.

We do not approach cost segregation as a mechanical reclassification of costs.

We approach it as capital recovery under uncertainty, requiring professional judgment, technical understanding, and conservative documentation.

This methodology is designed for environments where:

- Capital commitments are irreversible

- Asset lives are heterogeneous

- IRS, audit, and counterparty scrutiny is real

- The cost of being wrong is material

Foundational Principles

Our cost segregation work is governed by three foundational principles:

1. Economic Function over Architectural Form

Assets are classified based on how they function economically and operationally — not how they resemble building components.

2. Engineering Before Accounting

Systems must be understood technically before they are classified for tax purposes.

3. Appraisal Before Allocation

Capital must be reconciled and abstracted correctly before recovery periods are applied.

These principles distinguish defensible capital recovery from aggressive reclassification.

Step 1 — Engineering-Based Asset Identification

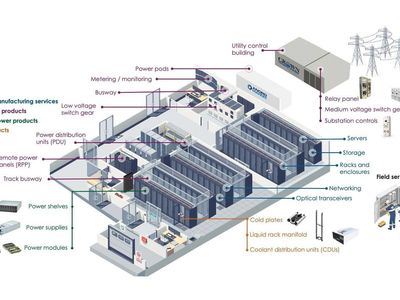

We begin with a technical understanding of how the asset is actually designed and operates, including:

- Electrical and mechanical systems

- Process and production infrastructure

- Structural supports tied to equipment and systems

- Utility, power, and control architectures

- Redundancy and resiliency elements where applicable

This ensures assets are classified based on economic function, not visual appearance or template categories.

Particularly in infrastructure, industrial, data center, and energy assets, this step is essential to prevent misclassification of system-driven capital as generic building components.

Step 2 — Appraisal-Based Capital Allocation

Before depreciation classification, we apply appraisal discipline to:

- Reconstruct total project basis

- Abstract non-depreciable land using market and residual techniques

- Identify and separate site improvements

- Reconcile all allocations internally

- Prevent distortions caused by improper shell or land allocation

This ensures depreciation outcomes reflect capital reality, not aggressive modeling or percentage-based shortcuts.

Land abstraction is treated as a critical risk area — not a residual afterthought.

Step 3 — Functional Asset Classification

Only after engineering identification and capital allocation do we classify assets into recovery periods, based on:

- IRS definitions and applicable guidance

- Functional relationship to production, power, or operations

- Physical and economic depreciation characteristics

- Integration with the larger system architecture

This process ensures that §1245, §1250, and non-depreciable components are assigned based on function and evidence, not optimization targets.

Step 4 — Internal Reconciliation and Quality Control

All studies undergo internal reconciliation to ensure:

- Total allocations match capitalized project costs

- No artificial inflation of qualifying property

- Logical consistency across asset classes

- Cross-validation between engineering, appraisal, and tax treatment

This step is essential to prevent:

- Over-allocation to short-life property

- Misalignment between systems and classifications

- Exposure during IRS or audit review

IRS-Defensible Documentation

Our documentation is structured to withstand:

- IRS examination

- CPA and auditor review

- Transactional due diligence

- Institutional governance standards

Every study emphasizes:

- Transparent classification logic

- Engineering support for functional assignments

- Full reconciliation to total project basis

- Conservative interpretation aligned with IRS guidance

- Documentation suitable for Form 3115 and related filings

Acceleration is pursued only when supported by function, documentation, and law — not aggressive reclassification.

Bonus Depreciation: Methodology Over Mechanics

With the restoration of 100% bonus depreciation for qualifying property placed in service on or after January 20, 2025, the quality of asset classification has become more consequential than ever.

Poorly executed or template-based studies may:

- Misclassify long-life property

- Over-allocate to qualifying classes

- Trigger IRS exposure

- Create downstream audit and financial risk

Our methodology ensures that bonus depreciation is:

- Applied conservatively

- Technically supported

- Institutionally defensible

Bonus depreciation amplifies both opportunity and risk — which makes methodology, not speed, the governing factor.

Why This Matters

Clients engage US Valuation for cost segregation when:

- Capital commitments are large

- Asset complexity is structural, not marginal

- Audit and governance standards are high

- The cost of being wrong is irreversible

- Traditional studies feel incomplete or overly aggressive

Our methodology is designed for defensibility, transparency, and long-term credibility, not short-term optimization.

Bottom Line

Cost segregation, when properly executed, is not a tax strategy.

It is a capital recovery discipline grounded in valuation economics, engineering understanding, and appraisal rigor.

At us, our methodology ensures that depreciation outcomes are:

- Aligned with economic reality

- Technically supported

- IRS-defensible

- Suitable for audit and institutional scrutiny

- Scalable across infrastructure and commercial asset classes

👉 Discuss Feasibility and Methodology

A confidential discussion to assess whether cost segregation is appropriate and defensible for your asset.

Copyright © 2018 MyFinancialValuation.com - All Rights Reserved. Cost Segregation Study, Commercial RE Appraisal & Business Valuation, Company Enterprise Valuation, Estate Tax Valuation, Gift Tax Valuation - All Rights Reserved.

David Hahn, Certified Valuation Analyst (CVA), Accredited Senior Appraiser (ASA), Certified Commercial Investment Member (CCIM), Certified M&A Advisor (CM&AA), Master Analyst in Financial Forensics (MAFF). State Certified General Appraiser Licensed in CA, WA, OR, NV, HI, TX, VA

RE Broker Licensed in CA, WA, GA, TX. .

- Home

- Enterprise Business Value

- CRE Industrial Value

- Data Center Valuation

- Purchase P A - Enterprise

- Holding Co & Family Firms

- 100% Bonus Depreciation

- Step-Up Basis Cost Seg

- 1031 Basis & Cost Seg

- QIP - Qualified Improv. P

- Cost Seg - CRE, Hotel

- Cost Seg - Industrial Mfg

- Cost Seg - Energy Assets

- Industries-Asset Classes

- Contact

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.